Navigating the Lebanese Health Insurance Minefield in 2026

If you are reading this, you likely feel the same anxiety as thousands of other Lebanese citizens: the fear that despite paying premiums for years, your insurance card might be rejected at the admissions desk of a major hospital. The transition from “Lollars” to Fresh USD is now complete, but the rules of the game have changed drastically.

While our general guide to health insurance covers the basics, this article is a deep dive into the technical regulations of 2026. We will explain how to secure “Class A+” care, enforce your rights under Decision 186/ICC, and avoid the hidden “loyalty taxes” that are draining your fresh dollar savings.

The “Fresh USD” Reality: Why Your Old Premium Doesn’t Matter

The “Cash-Flow Shock” Explained

Gone are the days of paying in checks or LBP at the 1,500 rate. In 2026, hospitals demand immediate settlements in cash USD to pay for fuel and imported medical supplies. This has forced insurers to shift entirely to Fresh Dollar premiums.

If you are still holding onto an old policy, you are effectively uninsured. Most hospitals will now ask for a cash deposit ranging from $2,000 to $10,000 before admission if your policy isn’t clearly marked as “Fresh” or “Real” USD.

Calculating the “Loyalty Tax”

Are you overpaying? Many insurers rely on your fear of switching to hike premiums aggressively. If your renewal premium increased by more than 15-20% this year without a claim, you might be paying a “loyalty tax.” Switching insurers is risky due to pre-existing conditions, but understanding your legal rights can help you negotiate.

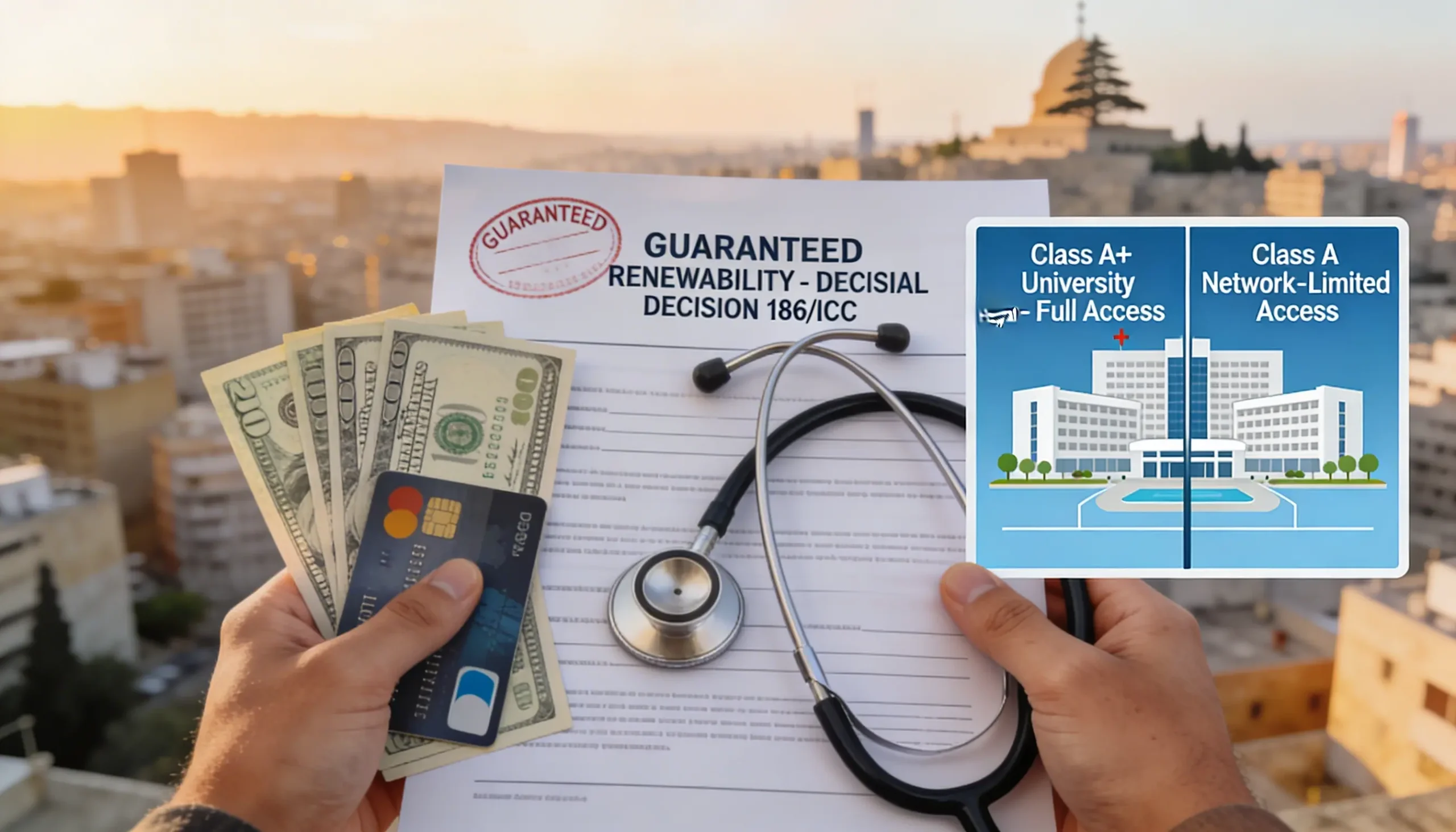

Guaranteed Renewability (GR): Your Most Valuable Asset

Understanding Decision 186/ICC: They Cannot Drop You

One of the few protections Lebanese policyholders have is Ministerial Decision No. 186/ICC. This regulation mandates Guaranteed Renewability (GR). This means that as long as you pay your premiums on time and act in good faith, your insurance company cannot cancel your policy or refuse to renew it, even if you develop a chronic illness like cancer or heart disease.

For more details on your consumer rights, read our breakdown of Insurance Laws in Lebanon.

The “Continuity” Clause: Switching Without Losing Coverage

Terrified of switching providers because of a pre-existing condition? You should look for the “Continuity of Coverage” (CoC) clause. If you switch from Insurer A to Insurer B with no gap in dates, you can often negotiate to carry over your “time served.” This means you won’t have to restart the 12-month waiting period for standard illnesses.

Hospital Networks 2026: The “Class A” vs. “University” Split

The AUBMC/CMC Surcharge

“Class A” doesn’t mean what it used to. Due to aggressive pricing by top-tier university hospitals (AUBMC, CMC, St. George), many insurers have split their networks.

- Standard Class A: Covers most private hospitals but excludes or applies a surcharge (15-20%) to university hospitals.

- Premium / Class A+: The new tier required to access top university centers with full coverage.

If your policy is “Class A” but you frequent Hamra or Ashrafieh, you must check your Table of Benefits specifically for the “University Hospital Surcharge.” You can compare the networks of the top providers in our Best Medical Insurance Companies review.

Pre-Existing Conditions & The “Material Fact” Trap

“Acute Onset” vs. Chronic Care

For elderly parents, distinguishing between Chronic and Acute Onset coverage is vital.

- Chronic Coverage: Pays for maintenance (e.g., dialysis, regular checkups). Expensive and rare in new policies.

- Acute Onset: Pays only when a chronic condition suddenly becomes life-threatening (e.g., a heart attack).

This distinction is particularly important for Expat Health Insurance plans, which often only cover acute emergencies.

Public Options: NSSF and MoPH Safety Nets

Despite funding injections, the NSSF (Daman) acts more like a discount card than insurance. It might cover a fraction of the “official” rate, but the difference between the NSSF rate and the “Real Market” rate is massive.

Relying on a “Difference of NSSF” (Complementary) policy is risky. If the NSSF delays approval or its system goes offline (a common occurrence), your private “complementary” insurance might refuse to pay the primary portion. For total peace of mind in 2026, a “Full Private” (NIL NSSF) policy is the only way to guarantee immediate admission.

Action Plan: 5 Steps Before You Renew

- Check the TPA: Is your network managed by a major TPA? They have better leverage to waive cash deposits.

- Confirm “Fresh” Terms: Ensure the policy wording explicitly says claims are settled in “Fresh USD” or “Real USD.”

- Review “Day 1” Newborn Coverage: Does the policy cover a baby from birth automatically, or is there a waiting period?

- Verify the GR Clause: Look for “Guaranteed Renewability” in the special conditions—do not accept a policy without it.

- Scan for the Surcharge: Specifically check if AUBMC/CMC are covered 100% or subject to a deductible.

Need help reviewing your renewal terms?

Contact The Guardian for a Free Policy Review

Frequently Asked Questions (FAQ)

What is the “Fresh Dollar” requirement for Lebanese health insurance in 2026?

The “Fresh Dollar” requirement mandates that all health insurance premiums be paid in cash USD or international transfers. This was implemented because hospitals now demand payments in real currency to cover imported medical supplies and fuel, refusing “lollar” checks or old exchange rates.

Can my insurance company refuse to renew my policy if I get sick?

No. Under Ministerial Decision No. 186/ICC, insurance companies in Lebanon are legally required to offer “Guaranteed Renewability” (GR) regardless of your age or health condition, provided you renew within the specific timeframes and have not breached the contract terms.

Do all “Class A” insurance plans cover university hospitals like AUBMC?

Not necessarily. Due to rising costs, many insurers have created a “Premium” or “Class A+” tier specifically for university hospitals like AUBMC and CMC. Standard Class A plans may now exclude these hospitals or require a significant co-pay or surcharge.