Securing health insurance in Lebanon has become more critical than ever. With changing economic conditions and rising medical costs, depending only on public funds can put you at risk.

For this reason, private health insurance is not just a luxury; it’s a vital investment in your health and financial security. At The Guardian, we fully understand the challenges faced by individuals and families seeking reliable healthcare coverage in Lebanon.

Therefore, this guide will help you understand health insurance in Lebanon and make wise choices, so that you and your loved ones can get the care you need.

For more information, you can contact our team of experts.

The current healthcare landscape in Lebanon presents significant challenges.

For example, many public health funds offer limited coverage, often covering only a small percentage of actual medical costs.

As a result, people often have to pay most of the expenses themselves, which can be a heavy financial burden during an illness or accident. For a deeper look at the public healthcare system in Lebanon, you can refer to reports from the Ministry of Public Health.

The current healthcare landscape in Lebanon presents significant challenges.

For example, many public health funds offer limited coverage, often covering only a small percentage of actual medical costs.

As a result, people often have to pay most of the expenses themselves, which can be a heavy financial burden during an illness or accident. For a deeper look at the public healthcare system in Lebanon, you can refer to reports from the Ministry of Public Health.

1. Access to Quality Care: Private plans offer access to more trusted hospitals, clinics, and specialists in Lebanon. This ensures you get quick access to high-quality medical services.

2. Financial Protection: A quality health insurance plan in Lebanon shields you from unexpected and potentially enormous medical bills for hospitalizations, surgeries, diagnostic tests, and expensive medications.

3. Peace of Mind: Knowing you have coverage reduces the stress of medical emergencies, allowing you to focus on getting better.

4. Tailored Solutions: Private insurers provide flexible plans that can be customized to fit your needs, family size, and budget.

1. Access to Quality Care: Private plans offer access to more trusted hospitals, clinics, and specialists in Lebanon. This ensures you get quick access to high-quality medical services.

2. Financial Protection: A quality health insurance plan in Lebanon shields you from unexpected and potentially enormous medical bills for hospitalizations, surgeries, diagnostic tests, and expensive medications.

3. Peace of Mind: Knowing you have coverage reduces the stress of medical emergencies, allowing you to focus on getting better.

4. Tailored Solutions: Private insurers provide flexible plans that can be customized to fit your needs, family size, and budget.

Why Private Health Insurance is Essential in Lebanon

The current healthcare landscape in Lebanon presents significant challenges.

For example, many public health funds offer limited coverage, often covering only a small percentage of actual medical costs.

As a result, people often have to pay most of the expenses themselves, which can be a heavy financial burden during an illness or accident. For a deeper look at the public healthcare system in Lebanon, you can refer to reports from the Ministry of Public Health.

The current healthcare landscape in Lebanon presents significant challenges.

For example, many public health funds offer limited coverage, often covering only a small percentage of actual medical costs.

As a result, people often have to pay most of the expenses themselves, which can be a heavy financial burden during an illness or accident. For a deeper look at the public healthcare system in Lebanon, you can refer to reports from the Ministry of Public Health.

Key Reasons to Invest in a Private Health Insurance Plan

1. Access to Quality Care: Private plans offer access to more trusted hospitals, clinics, and specialists in Lebanon. This ensures you get quick access to high-quality medical services.

2. Financial Protection: A quality health insurance plan in Lebanon shields you from unexpected and potentially enormous medical bills for hospitalizations, surgeries, diagnostic tests, and expensive medications.

3. Peace of Mind: Knowing you have coverage reduces the stress of medical emergencies, allowing you to focus on getting better.

4. Tailored Solutions: Private insurers provide flexible plans that can be customized to fit your needs, family size, and budget.

1. Access to Quality Care: Private plans offer access to more trusted hospitals, clinics, and specialists in Lebanon. This ensures you get quick access to high-quality medical services.

2. Financial Protection: A quality health insurance plan in Lebanon shields you from unexpected and potentially enormous medical bills for hospitalizations, surgeries, diagnostic tests, and expensive medications.

3. Peace of Mind: Knowing you have coverage reduces the stress of medical emergencies, allowing you to focus on getting better.

4. Tailored Solutions: Private insurers provide flexible plans that can be customized to fit your needs, family size, and budget.

Understanding Your Health Insurance Plan Options

- In-Patient Coverage: This is the core of most plans, covering medical expenses that happen during a hospital stay. Specifically, this includes hospital room and board, surgical fees, anesthesia, and doctor’s fees.

- Out-Patient Coverage (Optional Add-on): This covers medical services that don’t require an overnight hospital stay. It usually includes doctor’s consultations, lab tests, radiology, and prescribed medications.

- Maternity Coverage: Typically an optional add-on that covers expenses related to pregnancy, childbirth, and newborn care. It often comes with a waiting period.

- Chronic Disease Coverage: This is for pre-existing or long-term conditions like diabetes or heart disease. Sometimes it’s included in comprehensive plans or as an add-on, and it may also have a waiting period.

- International Coverage: Some premium plans provide coverage for medical treatment outside of Lebanon. This is especially helpful for frequent travelers or those looking for specialized care abroad.

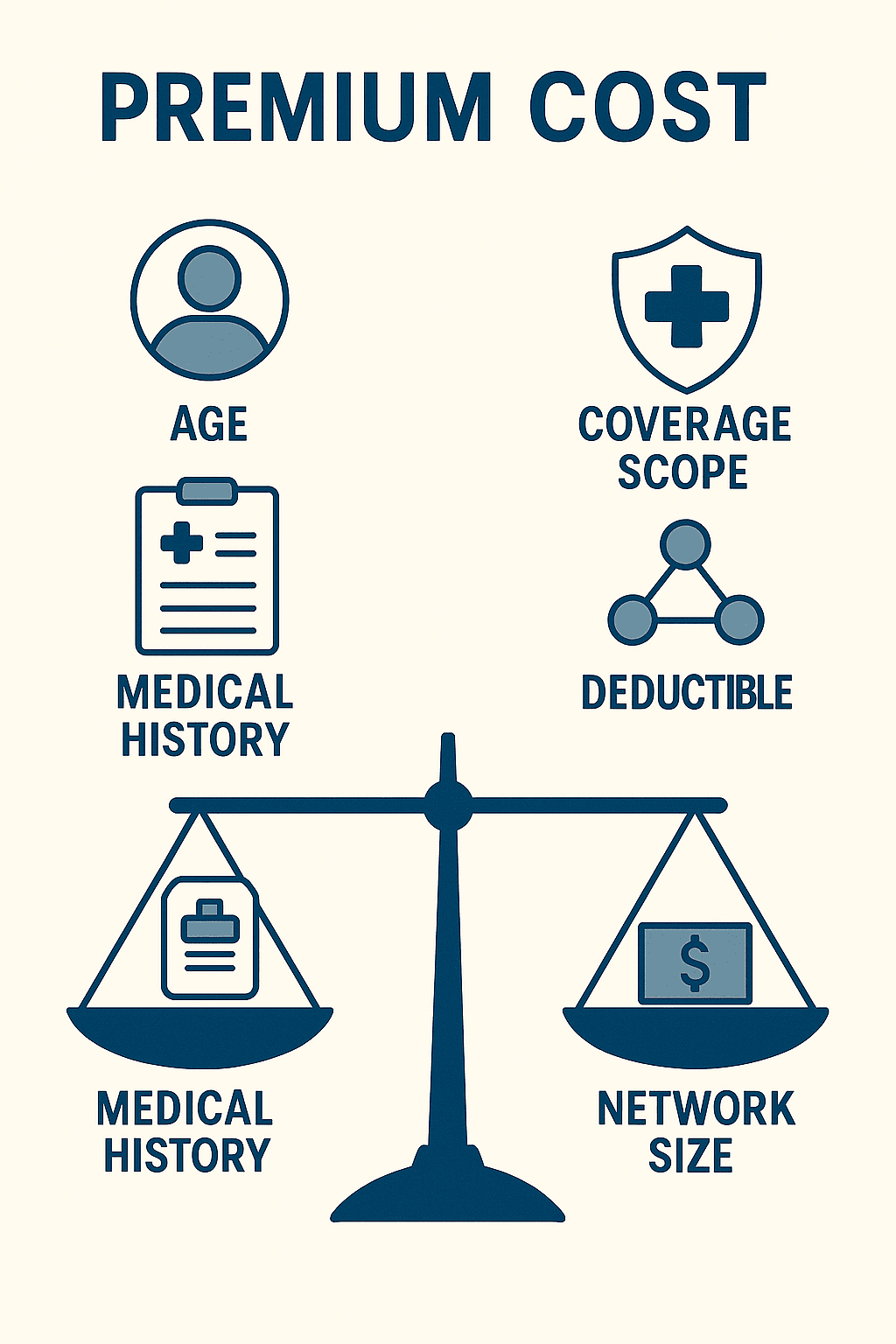

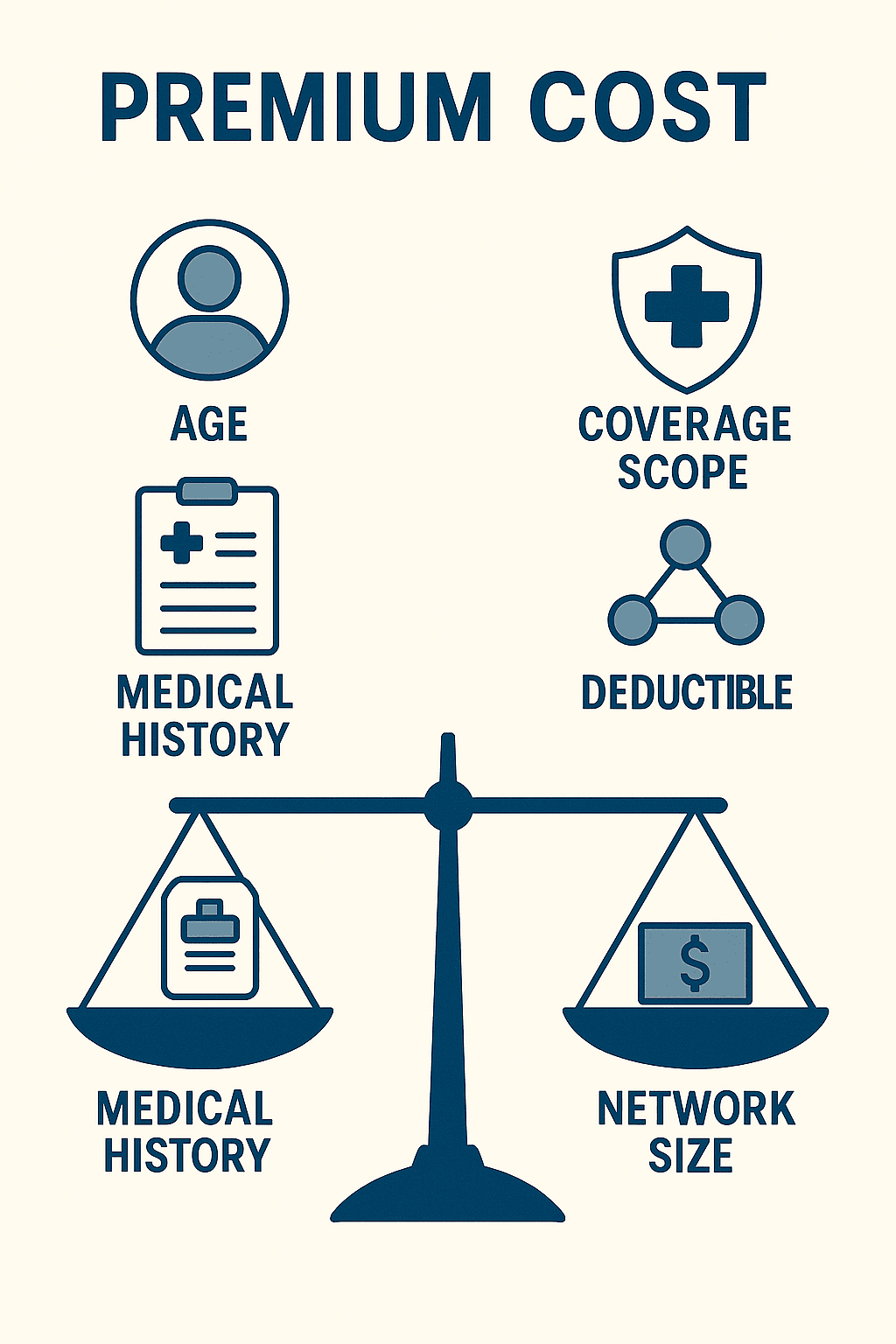

Factors Affecting Your Health Insurance Premium

- Age: Premiums generally increase with age, because the likelihood of needing medical care rises.

- Medical History: If you have pre-existing health issues, your premium may be higher. Furthermore, some conditions might also have a waiting period.

- Scope of Coverage: A comprehensive plan that includes in-patient, out-patient, and other extras will cost more than a basic plan.

- Deductible & Co-payment: A higher deductible means you pay more before your insurance starts covering costs. Similarly, a higher co-payment means you pay more of the bill yourself. In both cases, this usually results in a lower premium.

- Provider Network: Plans with a “Full Network” that include top hospitals like AUBMC and Hotel Dieu usually cost more than “Limited Network” plans.

- Guaranteed Renewability: Policies that guarantee lifetime renewal regardless of your health status might have a slightly higher premium, but they offer crucial long-term security.

How to Choose the Right Health Insurance Plan in Lebanon

- Assess Your Healthcare Needs: Are you single or do you need coverage for a family? Do you have chronic conditions or plan for maternity?

- Define Your Budget: Figure out how much you can comfortably pay in premiums. Also, think about your ability to handle deductibles and co-payments.

- Understand Network Access: Make sure your preferred hospitals and doctors are within the plan’s network.

- Compare Coverage & Exclusions: Go beyond just the premium. Instead, compare the benefits, sub-limits, waiting periods, and specific exclusions across different plans.

- Evaluate the Insurer: Research the insurance company’s reputation for customer service and claims settlement. This is vital for a smooth and transparent process.